Seneca Company Valuation

Value-based business management

Be in control of the situation!

Principally you perform a company valuation when there is going to be a change of partners, a succession or a takeover.

But even if there is no plan of restructuring, value-based business management is very reasonable. By analyzing the company value regularly, you build a solid base for each decision and convincing arguments are all yours.

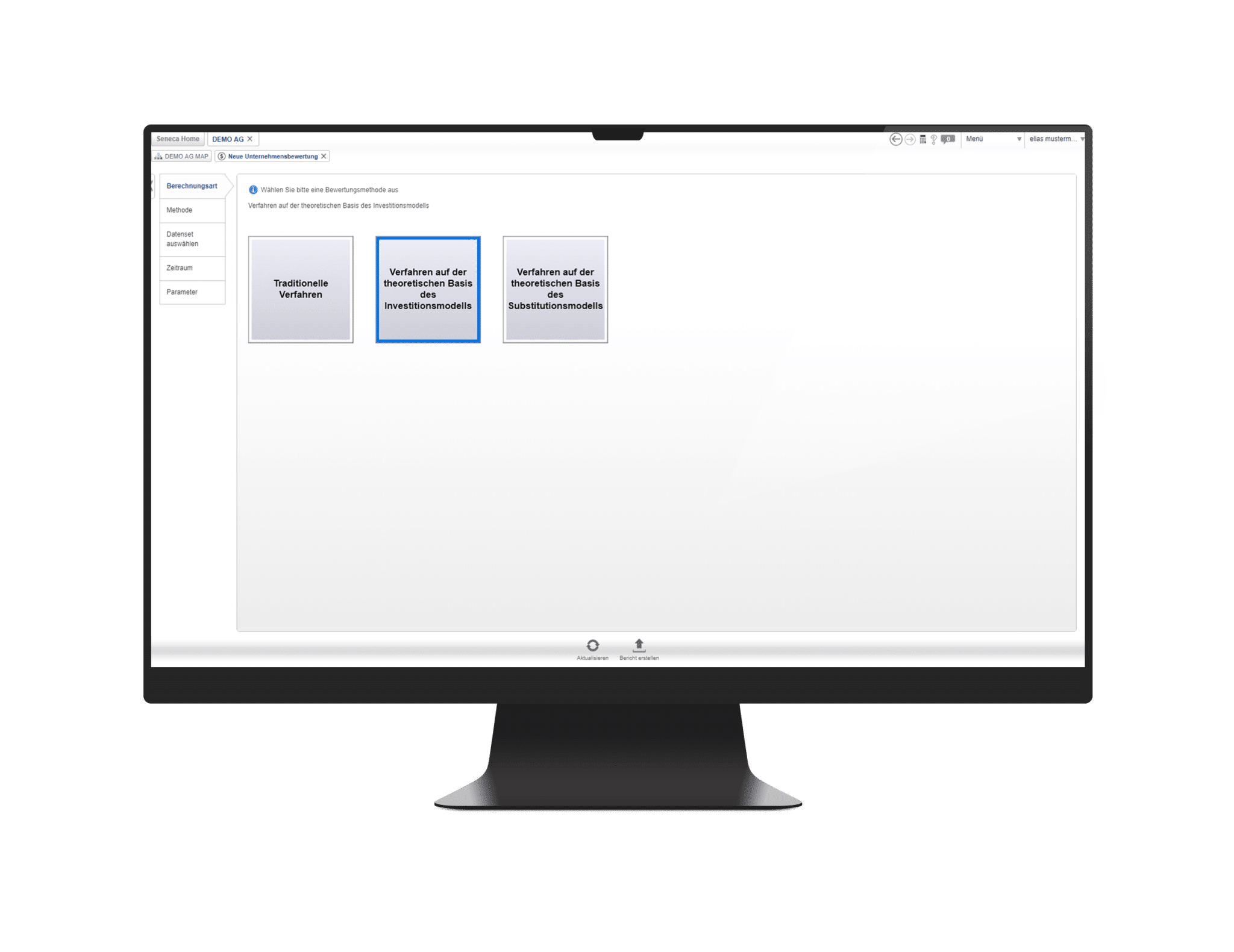

Professional valuation for everyone!

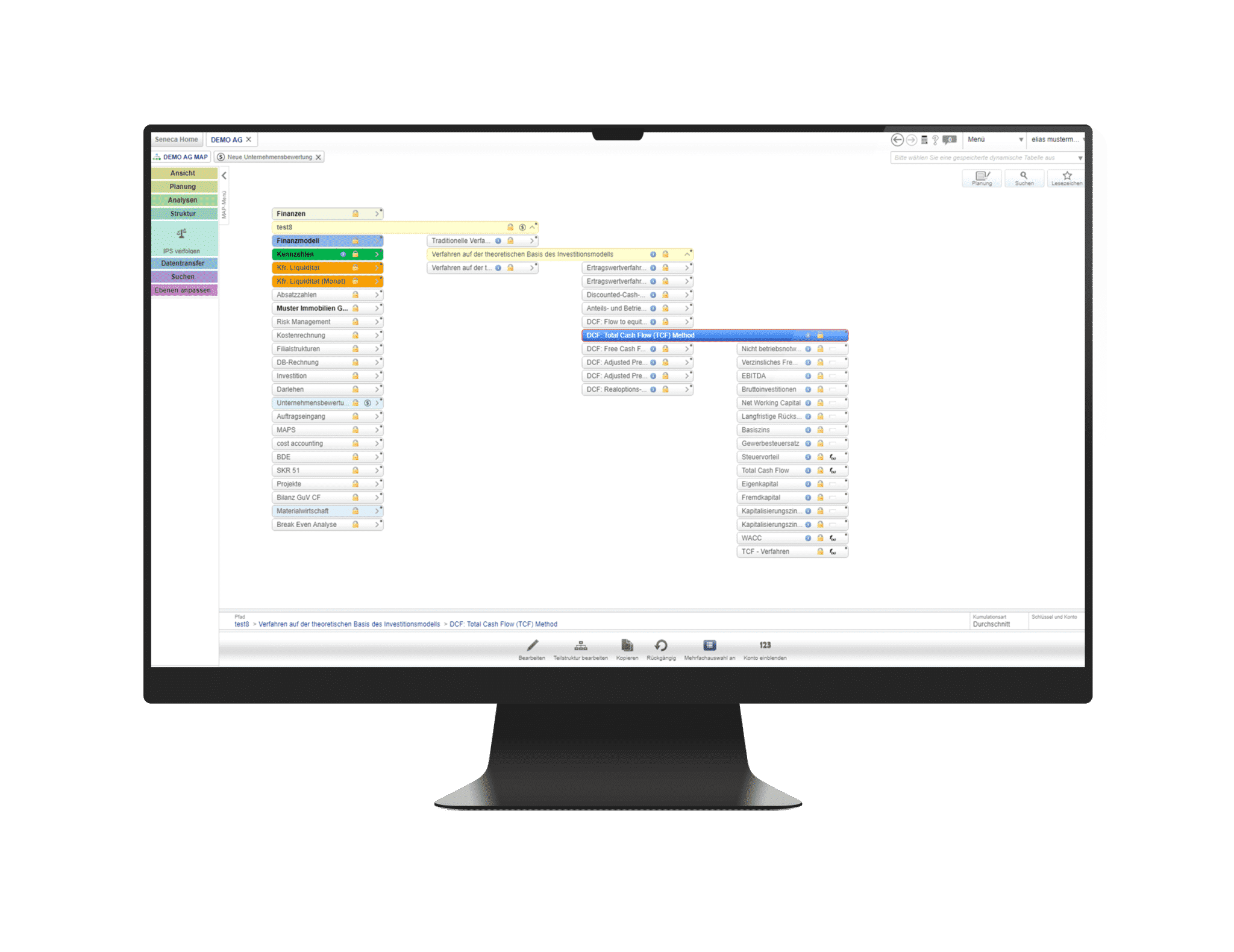

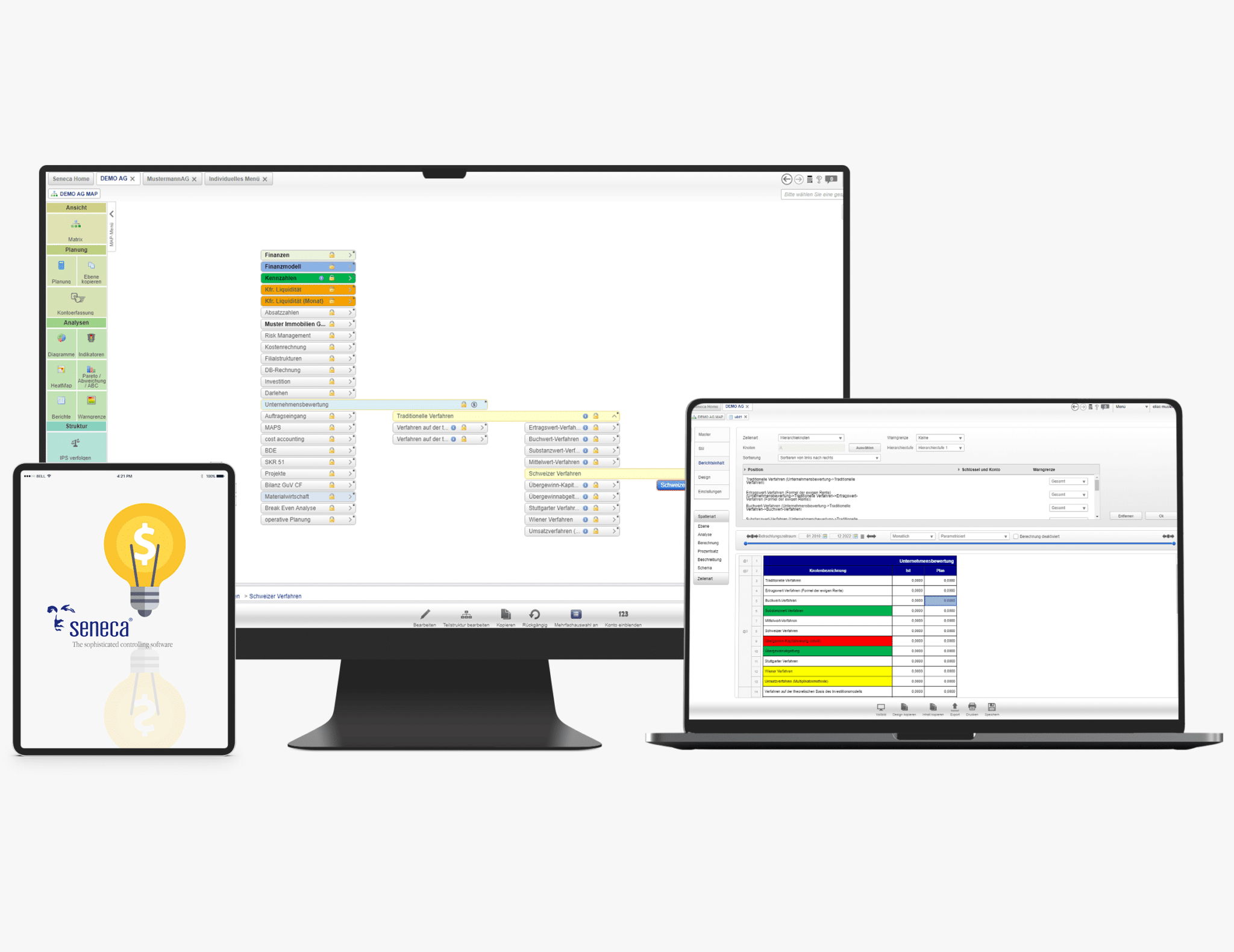

Use the module Seneca Company Valuation to find out about the value of your company quickly and easily. All required data is inquired and provided by Seneca Management Accounting – just choose the method you wish for and get started! From entrepreneur to shareholder: The module Seneca Company Valuation answers all claims of all different kinds of users.

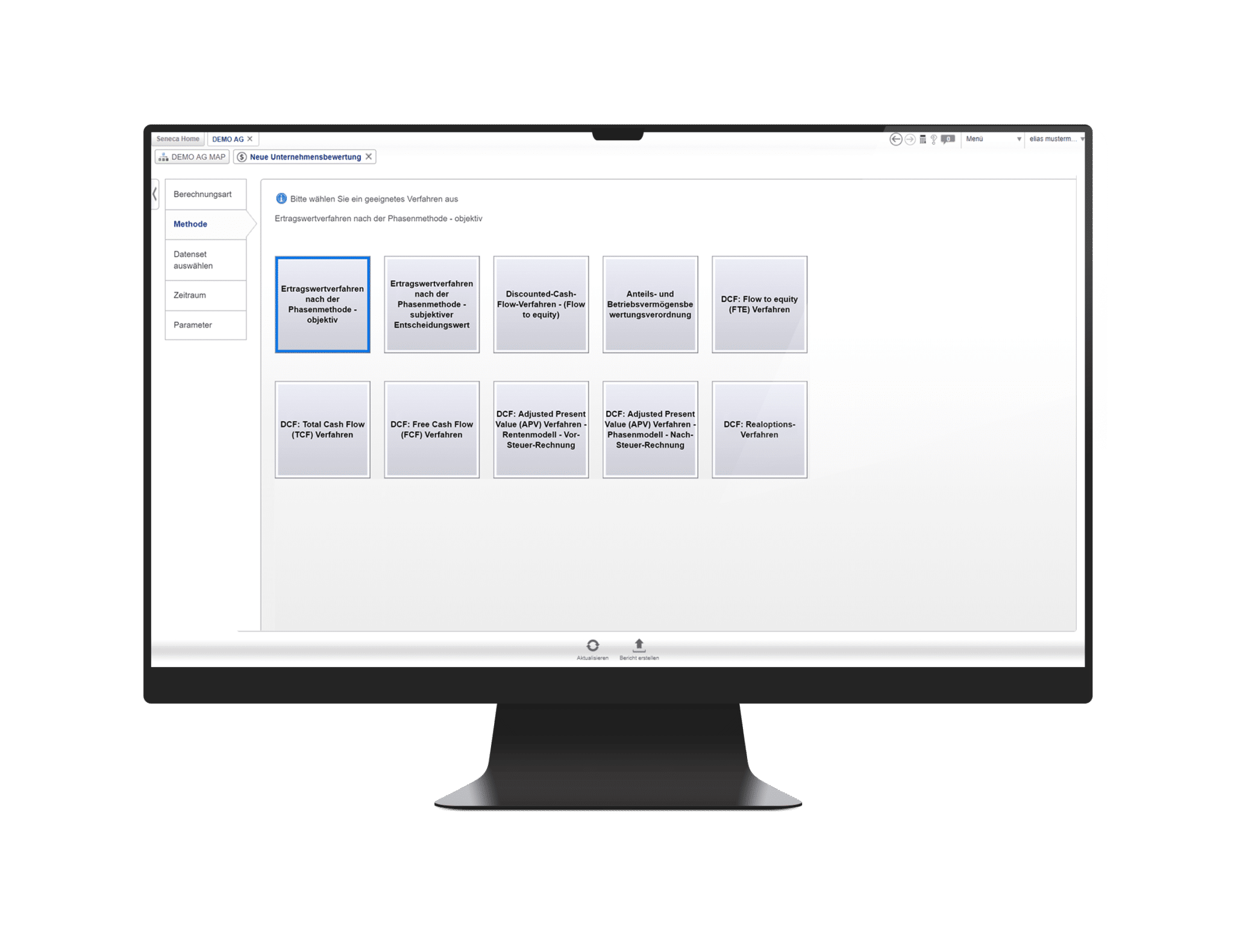

One value is not like another

In Seneca, you have thirty different methods for the valuation of your company. With it, all classic methods are covered and thus you can analyze the company value from different perspectives to identify the companies’ value drivers. As a result, companies of each size can have a benefit: from Start-ups to Global Players!

See the range of results in the automatically generated reports

Net Asset Value

provides information about how much fund would be necessary to establish the company once again. This is a fixed parameter in the real estate industry.

Free Cash Flow Method

is used to show which current and coming cash flows do affect the present value of your company.

Dealprice and the Multiple Method

can calculate the strategic value of the acquisition in an M&A transaction, based on the current revenue situation.